🎯 Key Takeaways

Hey, welcome to Module 4: Market Adaptation! This is all about learning to switch things up when the market does, because if you keep doing the same old thing no matter what, you're in trouble. A ton of traders miss this, and it costs them. Here's what you're getting:

- Slick tricks to spot and trade trending and ranging markets like a pro

- The know-how to catch when the market's changing its tune

- Simple rules for when to jump in and when to just kick back

4.1 Market Regime Recognition

First up, you've got to figure out what the market's up to—is it trending or just chilling in a range?

Identifying Market Structure Shifts

Here's my go-to: keep an eye on the big levels. When price punches through major support or resistance, that's your signal something's shifting.

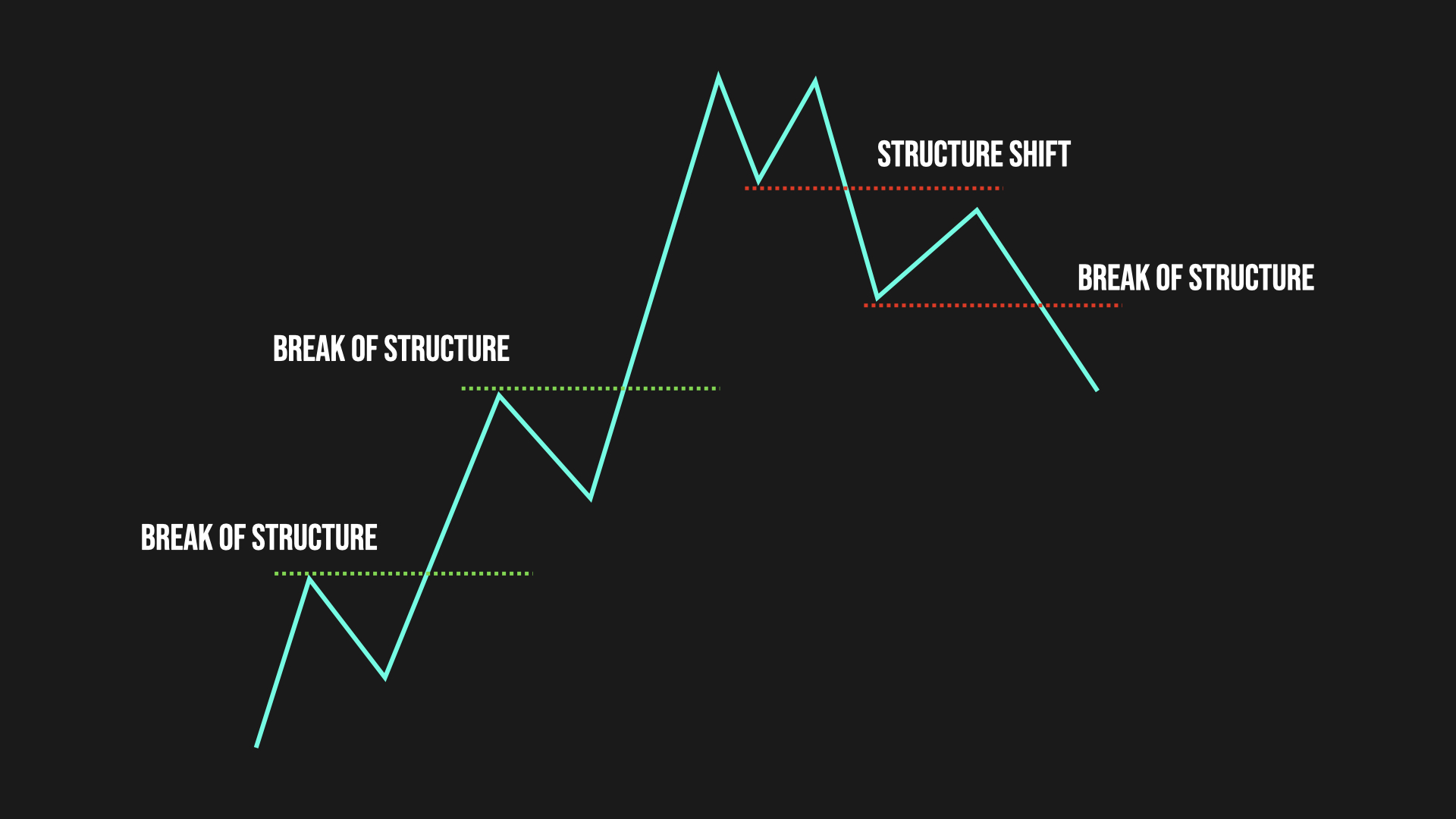

Market structure essentials

Structure shifts are when things flip. Say you're in an uptrend—price breaks a higher low and drops to a lower low, that's a red flag the trend's weakening. Maybe it's about to reverse or go sideways. In a downtrend, it's the opposite—price cracks a lower high and climbs to a higher high.

Break of structures is when price keeps smashing highs or lows in the trend's direction, telling you the trend's still rocking.

When I spot these, I tweak my entries to fit what's going down.

4.2 Trading in Trending Markets

Now, let's chat about trading when the market's got a clear vibe—up or down.

Trend Identification and Confirmation

Step one: nail down the trend—is it climbing or tanking? Get a feel for it with market sentiment and the big economic picture. For jumping in, I like breakouts or breakdowns way more than just testing support or resistance.

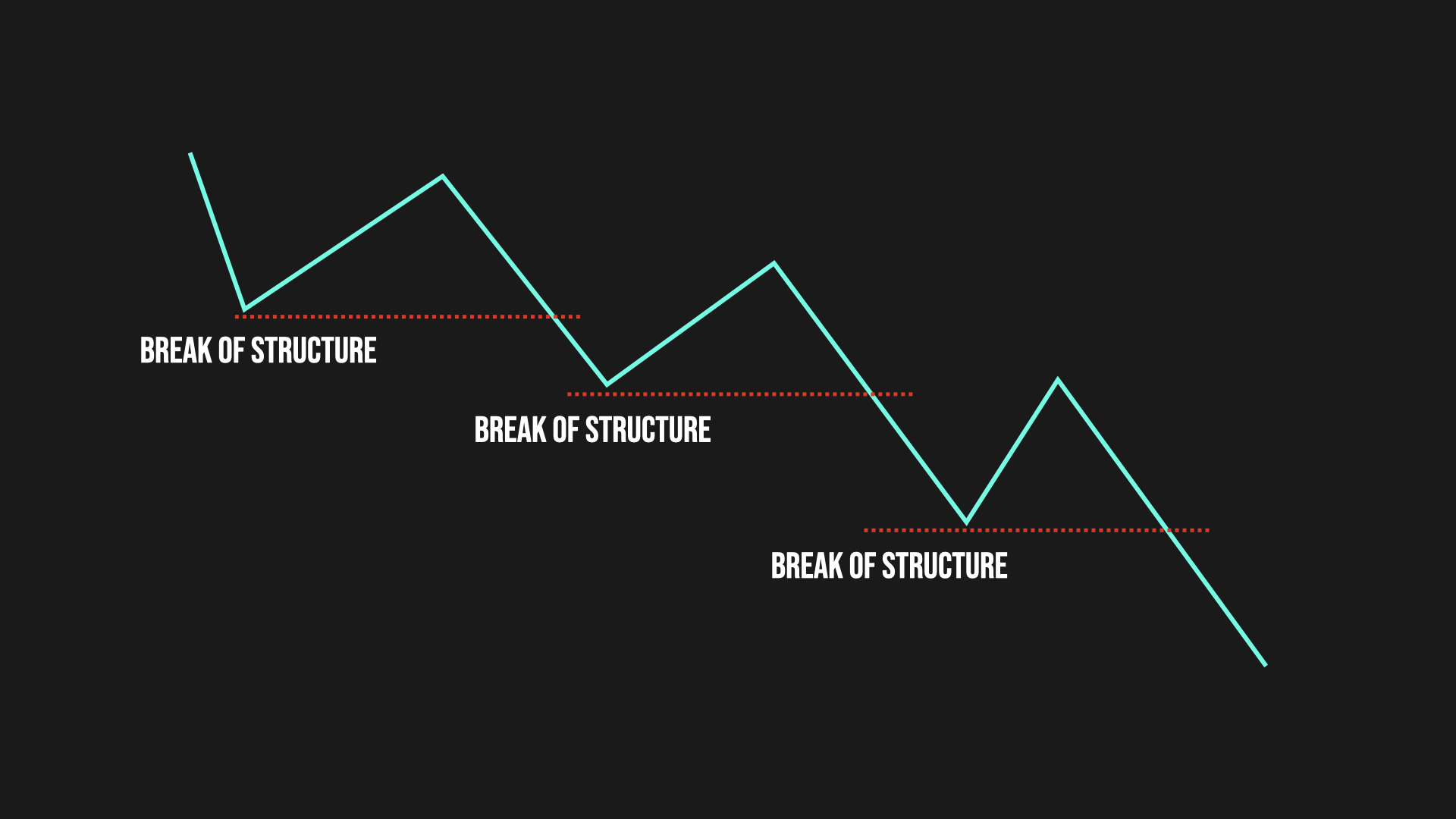

Downtrending market

In a trending market, levels don't hold—they get smashed fast. So, shorting resistance in an uptrend? Sketchy move. Buying support in a downtrend? Same deal—risky stuff.

Market Pullbacks

Market pullback gap entry

Even in an uptrend, price takes a breather and pulls back. That's when I hunt for gaps or order blocks (you remember those from Module 2, right?) to buy the dip. In a downtrend, it's the flip—price bounces up a bit, and I use those spots to short.

Momentum Continuation

Trends can keep rolling longer than you'd guess. That's your shot to ride it out, especially after a little pause or a big surge.

4.3 Trading in Ranging Markets

Okay, what about when the market's just bouncing around with no real direction?

Range Identification

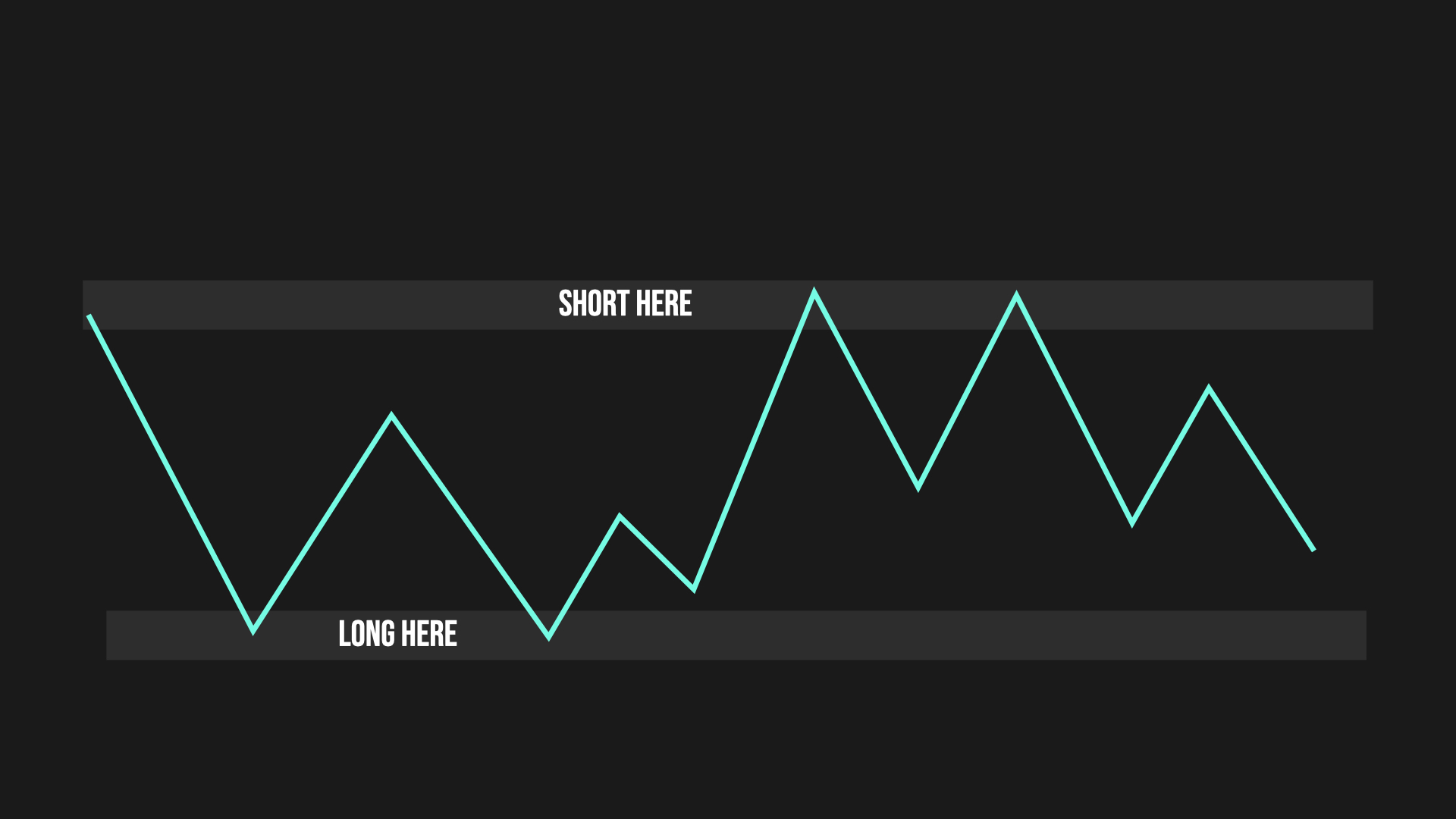

Start by marking the range's edges—top is resistance, bottom is support. Those are your goldmine zones for trades.

I stick to the outer edges—they're the heavy hitters with better odds.

Trading Range Boundaries

Ranging market boundaries

When price hits the top, I go short; when it drops to the bottom, I go long. For targets, aim across the range—shorting? Shoot for support. Going long? Aim for resistance.

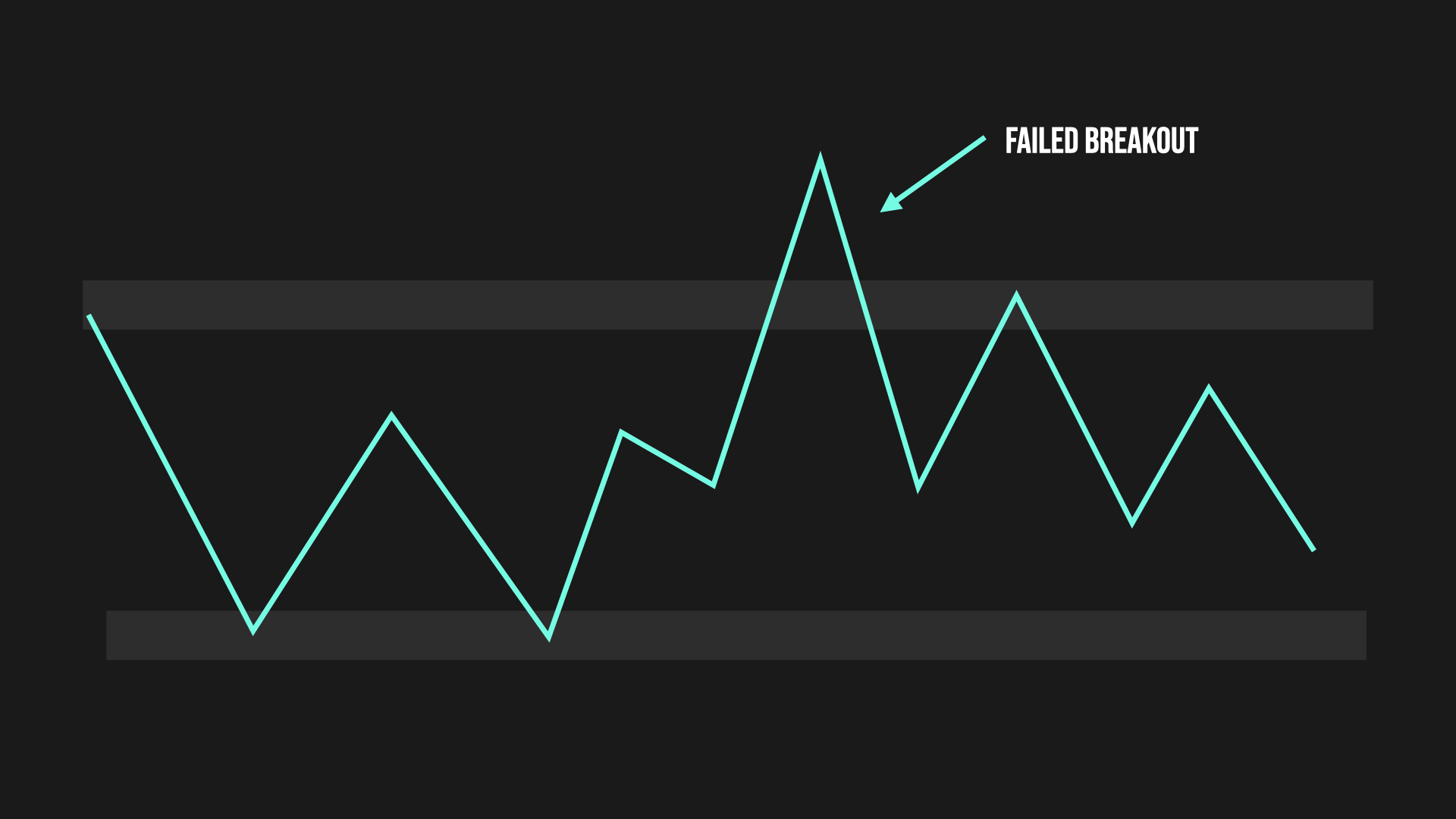

Failed Breakouts / Breakdowns

Failed breakout example

Sometimes price fakes you out—pokes past the range but snaps right back. If it retreats quick, that breakout's a bust, and the range is still on.

4.4 Adapting Your Approach

Time to weave all this into your trading plan.

Adapt Trading Strategy to Changing Conditions

Set up your plan with different moves for trending versus ranging markets. Customizing beats slapping the same strategy on everything.

When to Step Aside from Trading

If the market's a mess, bouncing between trends and ranges like crazy, just sit it out for the day.

🎓 Closing Thoughts

Work these ideas into your trading plan. It'll bump up your wins and keep you from chasing trades that don't match the market's mood.

Next up, we'll dig into building a killer trading routine in the next module.