🎯 Key Takeaways

In Module 3, you'll take your market knowledge and turn it into a solid trading plan that's tailored to you. By the end, you'll have:

- A complete trading strategy with clear rules

- A handful of high-probability entry techniques

- Entry and exit strategies to keep your capital safe

- A systematic way to find trade setups

3.1 Entry Techniques

Let's kick things off with how to actually enter a trade. Here are some tried-and-true techniques you can add to your playbook.

Breakouts and Breakdowns

One of the main ways to jump into a trade is by catching breakouts or breakdowns at key levels. But here's the trick: don't rush in right when it breaks! Wait for the price to come back and test that level again. Why? Because a lot of breakouts fizzle out fast, and you don't want to get caught in a fake move. If the price sneaks back into the old range during the test, skip the trade—it's not worth it.

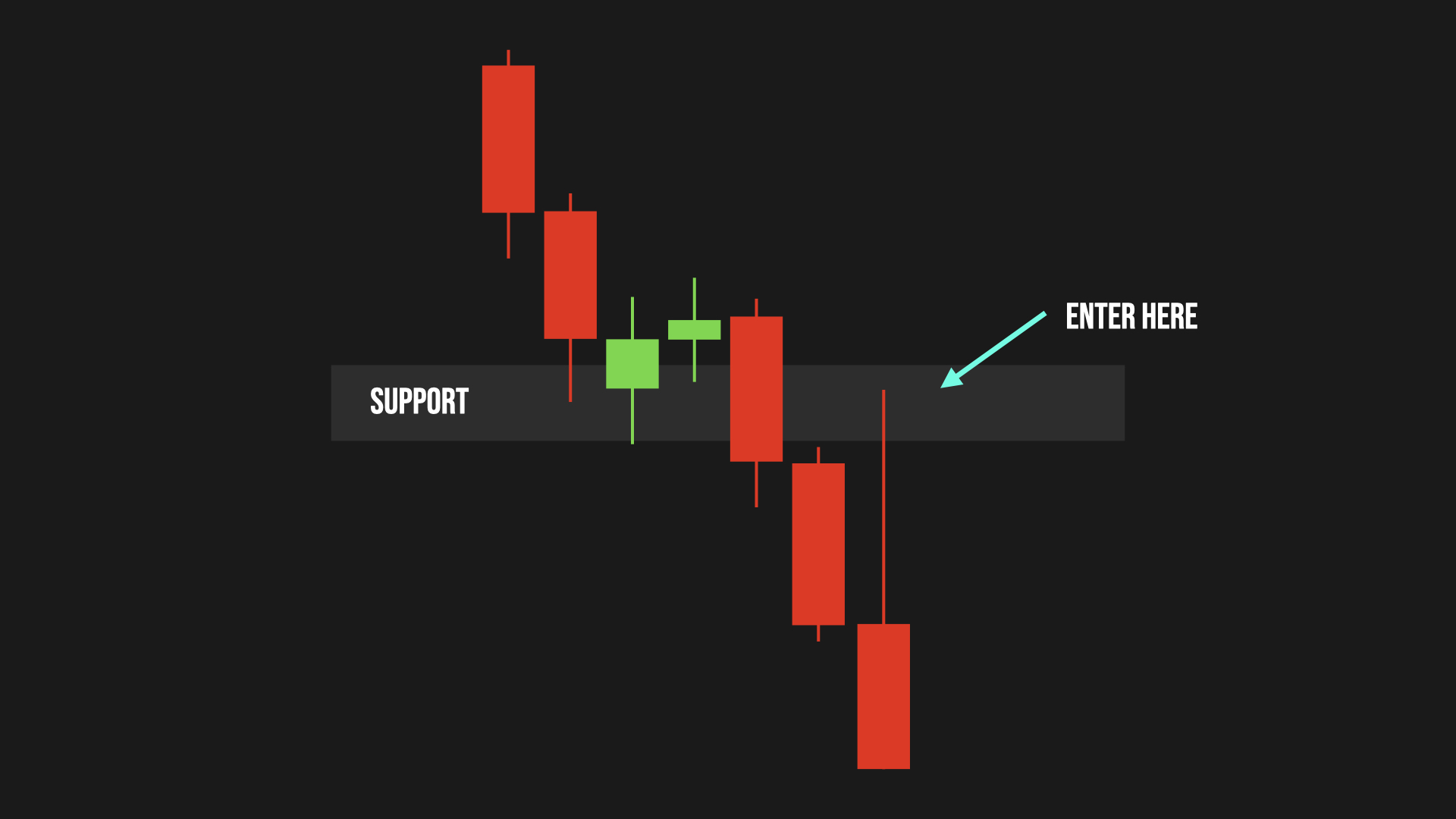

Retest of broken support

Take a look at this chart. After support breaks, don't enter right away. Wait for the price to swing back to that zone—now it's acting as resistance—and watch for a rejection, like a long wick on a candle. If you see that, enter near the old support (now resistance) and set your stop loss just above it.

Retests of Key Levels

Next up: trading at key levels. The basic idea is simple: buy at support, sell at resistance. But remember, these levels don't last forever—they break eventually. So, always wait for some confirmation before you jump in.

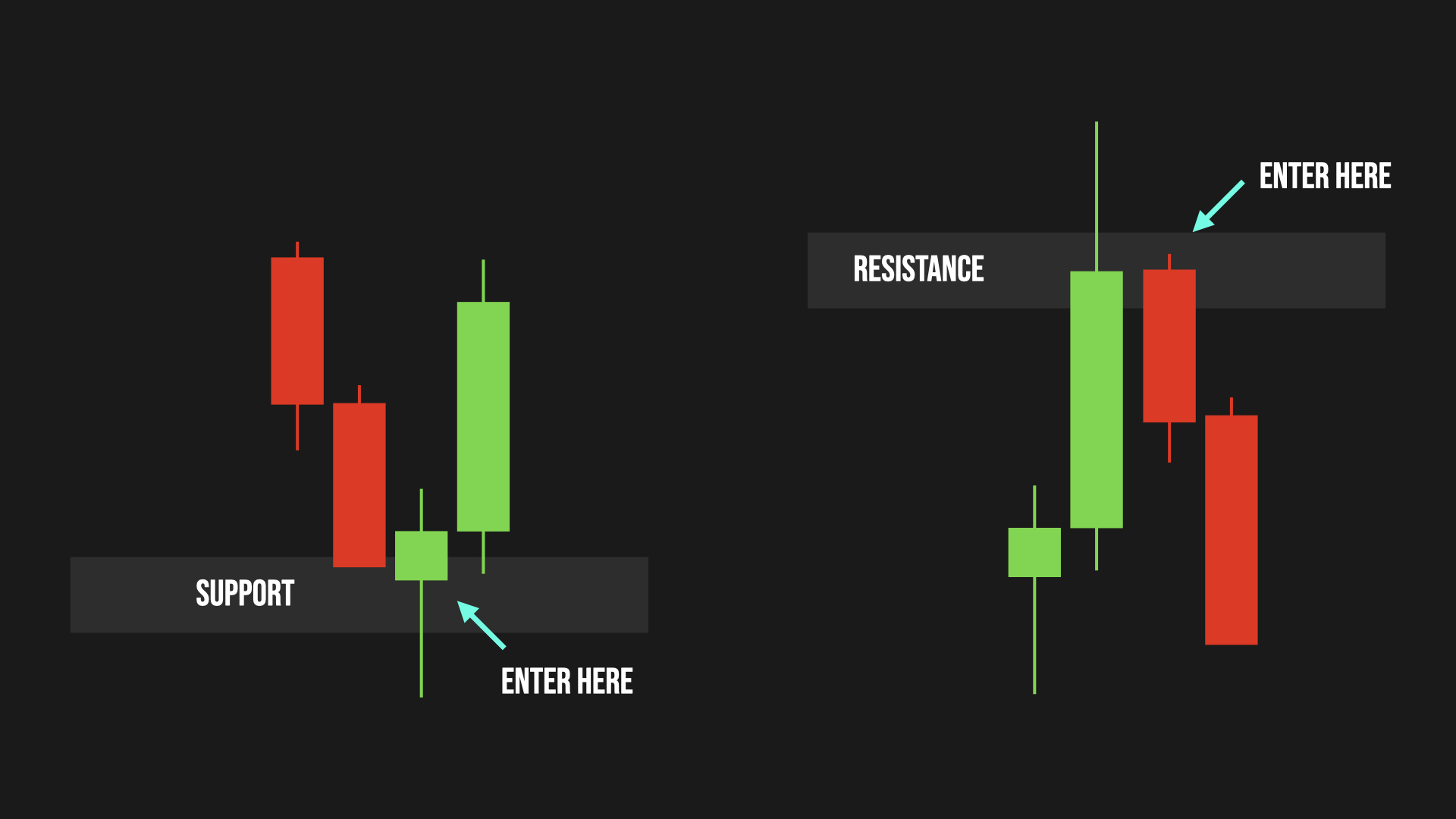

Rejection from key level

Check out this example. Price hits a zone and gets rejected hard—that's your signal. Wait for the candle to close, see how it looks, and then make your move.

Dynamic Entries (Ichimoku)

This one's great for quick scalp trades. Wait for a clear trend, up or down, and use the Ichimoku cloud to time your entry during small pullbacks. On smaller timeframes, price doesn't move in a straight line; it zigzags. The cloud acts like a moving support or resistance, perfect for catching those dips.

3.2 Exit Strategies

Alright, so you've got your trade on—now, how do you get out? There are a few ways to handle this.

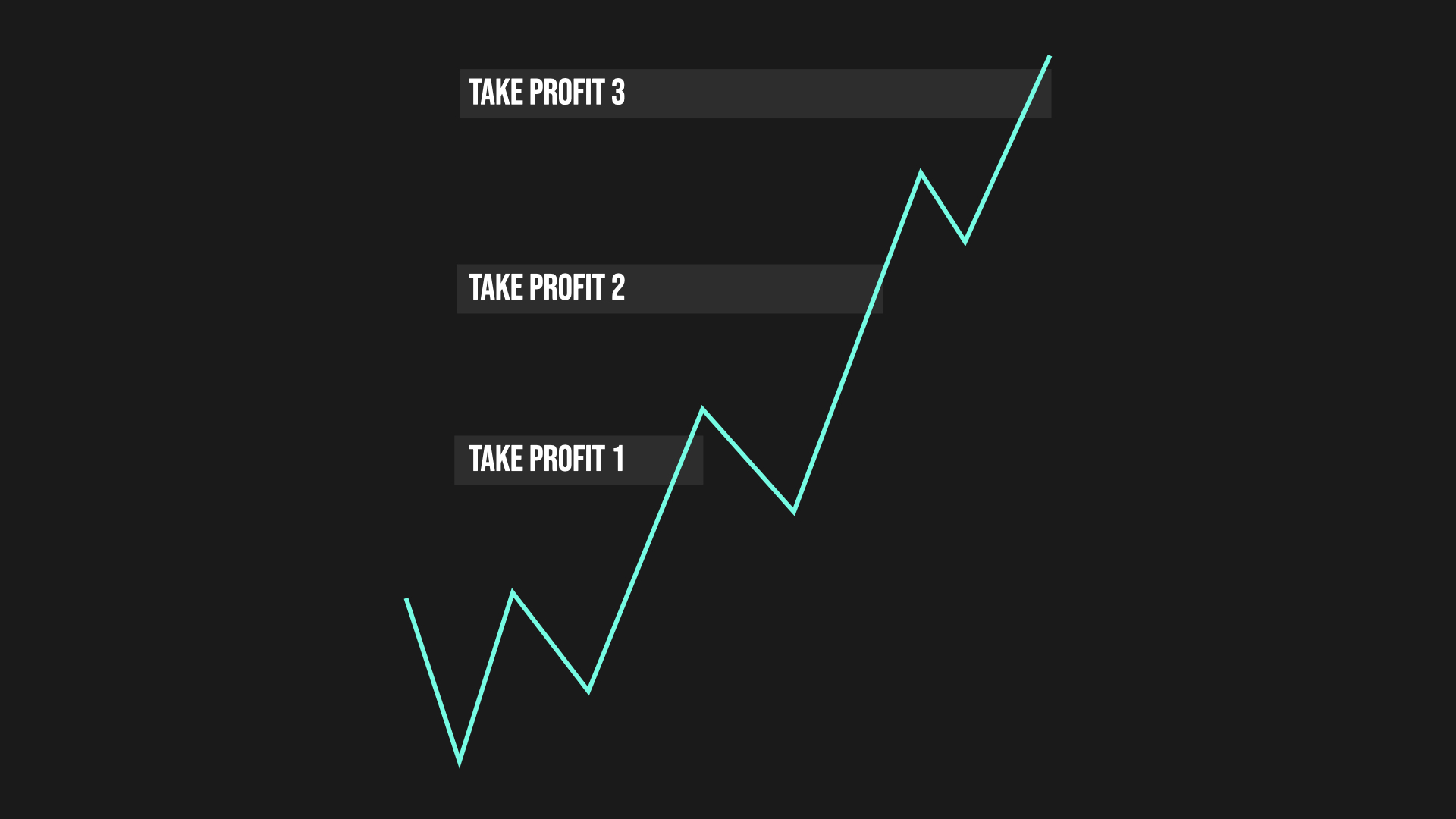

Scaling Out Techniques

One popular method is scaling out—taking profits bit by bit. Set some targets and cash out in chunks. For example:

- Close 1/4 of your position at 3% profit

- Close another 1/4 at 8% profit

- Take the rest at 12% profit

Scaling out example

This works well for day trading, swing trading, or even longer-term plays.

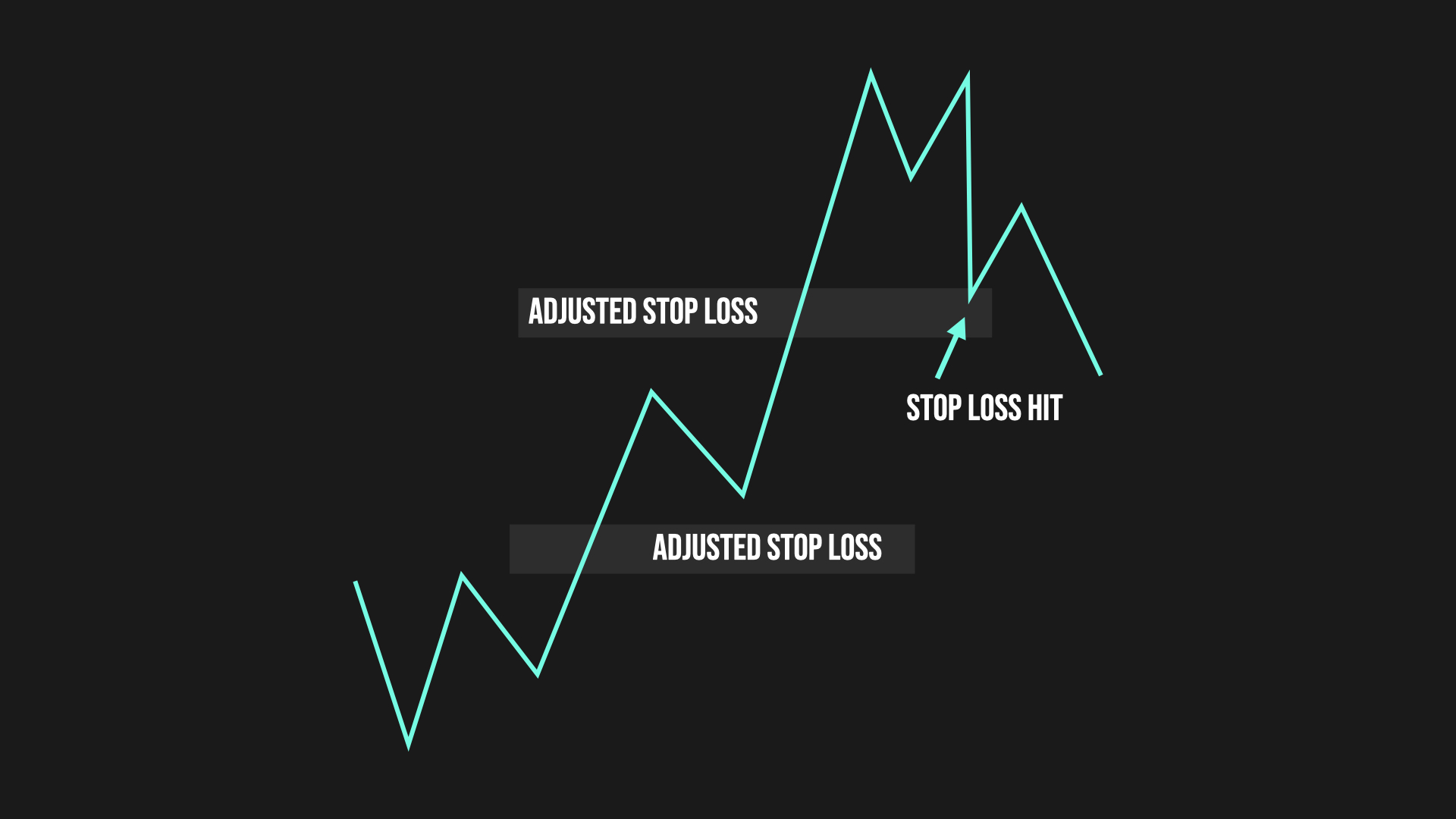

Trailing Stops

Another option is using a trailing stop. Instead of a fixed target, you let a moving stop loss do the work. As the price moves in your favor, you slide the stop up. When it gets hit, you're out.

Trailing stop loss

But be careful—set it too tight, and a small dip could kick you out early. I like using trailing stops to lock in break-even once a trade's doing well, not as my main exit.

Full Exit

The simplest way: set a stop loss and a profit target, then stick to them. Hit your take profit? Done—close it all.

3.3 Strategy Components and Design

Let's build your strategy from the ground up—the rules that tell you when, how, and what to trade.

Personal Rules

Start with your schedule. When can you trade? If it's fixed, maybe you've got a window like mine: 6 PM to 10 PM daily. If it's all over the place, sit down on Sunday and map out your week. Block off focused trading time—no checking charts on your phone randomly. That's a recipe for bad trades.

Then, set your risk rules:

- Max daily loss (say, $100)

- Max trades per day (maybe 3)

- Daily profit goal (like $200—once you hit it, stop)

Stopping at your profit target keeps you from overtrading and giving back your gains.

Entry Criteria Development

Here's where you decide when to pull the trigger. Based on the technical stuff we've covered, here's what to look for:

Short Entry (Selling)

- Bearish trend in the market

- Volume backing up that downward vibe

- Price hitting resistance (like the Ichimoku cloud, order blocks, gaps, or supply zones)

- Retests of broken support for shorting

- In a range? Sell at the top resistance

Long Entry (Buying)

- Bullish trend going strong

- Volume showing upward momentum

- Price at support (same zones as above)

- Retests of broken resistance for buying

- In a range? Buy at the bottom support

Exit Methodology Framework

Time to plan your exits. You could:

- Set a fixed profit target (like 2%) and stop loss (like 1.5%), no tweaking once it's live

- Use a trailing stop: start with a stop loss, move it to break-even at 1% profit, lock in 1% at 2% profit, etc.

- Take partial profits for big wins: 25% at 3%, 50% at 6%, rest at 10%

💡 Try This Out:

Play around with these exits. I stick to fixed percentages, but you might vibe with something else!

Trade Principles

Stick to these golden rules:

- Follow your trading plan, no exceptions

- Don't mess with your stop loss after it's set

- Stay within your risk limits

- Keep emotions out of it—analyze with a clear head

📋 Building Your Trading Plan

Time to put it all together! Your trading plan is your roadmap, so make it yours.

Download the Trading Plan Template

Use this template to lay it out. It'll help you track how you're doing and grow as a trader. In Module 4, we'll tweak it for different market vibes, but for now, nail down a strong base to start with.